Contents

ToggleBlog 4- Jan Samarth Portal-One stop solution for Govt Sponsored Loan Schemes

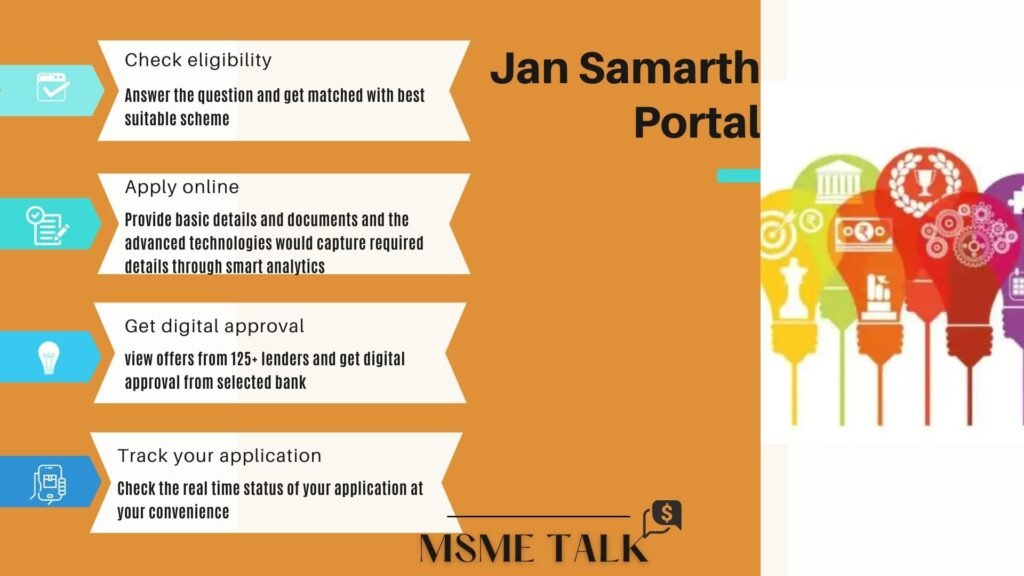

What is Jan Samarth Portal: Jan Samarth, a first-of-its-kind digital platform launched by Government of India that connects beneficiaries directly to lenders and it aimed to make government initiatives more accessible to all beneficiaries. It is completely based on credit-linked government schemes. The one-stop digital portal has 13 government credit initiatives on a single platform with 4 loan categories.

With the help of this single platform, the lenders and beneficiaries can connect seamlessly. The initiative’s main advantage is the quick application process by which a beneficiary can check their eligibility and criteria, upload necessary documents and process the business loan application in a few simple steps. A beneficiary can do all this remotely from anywhere with the ease of convenience of the beneficiary.

(Follow MSMETALK podcast, where we bring experts from the Industry to give value addition guidance, to scaleup and build long lasting business)

Features of the Jan Samarth Portal

The Jan Samarth Portal is a countrywide portal for government credit-linked programmes. Let us look at the features of the portal:

- Facilitates a single-window facility that links 13 Government credit schemes with lenders.

- As for now, only 13 schemes have been boarded, but sooner there will be more such credit schemes incorporated into the platform.

- Consists of 4 major board categories of the loan, namely Educational, Agri Infrastructure loan, Business Loan and Livelihood Loan.

- Provides a single platform to connect with 125+ lender institutions, including all public bank sectors, all at a single-window facility from which a beneficiary can choose as per their preferences

- Has numerous official digital integrations making the application process much easier and smoother between the beneficiary and all member financial institutions.

- The lender will verify the eligibility through the portal, financial lenders will give preliminary approval, and the portal will send an application to the selected Bank.

- Additionally, the beneficiaries will be updated through the portal at every step of the process without having to visit bank branches multiple times.

Eligibility for Applying on Jan Samarth Portal

Any individual can apply for a loan on the Jan Samarth portal. A person wanting to apply for a loan should check the eligibility under the required loan category. If the individual is eligible, he/she can apply for a loan through an online application.

An individual can check the eligibility by clicking on the ‘Schemes’ option on the homepage of the Jan Samarth portal, selecting the loan category from the drop-down list and clicking on the respective government scheme. The government scheme eligibility and information will be displayed on the screen.

(To gain an insight on value added information for MSMEs ,Startups follow MSMETALK on Linkedin, Instagram, Facebook,Twitter)

Steps to Apply for Loan on Jan Samarth Portal

The steps to apply for a loan on the Jan Samarth portal online are as follows:

Step 1: Visit the Jan Samarth portal and click on the ‘Schemes’ option on the homepage.

Step 2: Select the loan category from the drop-down list and click on the respective government scheme.

Step 3: Read the information and eligibility details and click on the ‘Check Eligibility’ option available on the page.

Step 4: Answer the basic questions on the next page and click on the ‘Calculate Eligibility’ option.

Step 5: A suitable scheme will be suggested to the beneficiary based on the response to the questions. Click on the ‘Apply Now’ button under the suggested scheme.

Step 6: The registration page will open. Enter the mobile number captcha and click on the ‘Get OTP’ button.

Step 7: Enter the OTP sent to the mobile number and click on the ‘Submit’ button.

Step 8: The registration form will appear. Enter the required details, upload documents and click on the ‘Submit’ button.

Step 9: The beneficiary can view offers from more than 125 lenders and get digital approval from the selected bank.

Step 10: The beneficiary can check the online status after applying for a loan scheme.

Process to Check Application Status on Jan Samarth Portal

After applying for a loan scheme, the beneficiary/applicant can check the status of his/her loan application on the Jan Samarth portal by following the below process:

- Visit the Jan Samarth portal.

- Click on the ‘Login’ button.

- Enter the email address/mobile number and captcha code and click on the ‘Login’ button.

- Click on the ‘My Applications’ tab on the dashboard.

- Use the registration credentials to check the application status.

Documents Required for Applying on Jan Samarth Portal

To apply for a loan under a government scheme on the Jan Samarth portal, the applicant needs to submit the following documents:

- Aadhaar number.

- Voter ID.

- PAN card.

- Bank statements.

(Follow msmetalk linkedin for information for MSMEs, Startups , Entrepreneurs)

Also, check our blog How to sell your products and services to Government to know how a Government procurement portal has turned out to be a lucrative platform for the growth of startups and msmes.

Loan Schemes Available on Jan Samarth Portal

As of now, there are four main loan categories under which different credit-linked government schemes are stated. The loan categories are as follows:

1.Business Loan

A beneficiary can avail of this category loan for expansion of existing business or new business. Different schemes under this category provide various benefits in classification based on gender, type of business, and economic sector. As of now, six schemes are enlisted under this major business loan category:

- Prime Minister’s Employment Generation Programme (PMEGP)

- Weaver Mudra Scheme (WMS)

- Pradhan Mantri MUDRA Yojana (PMMY)

- Pradhan Mantri Street Vendor Atma Nirbhar Nidhi Scheme (PMSVANidhi)

- Self-Employment Scheme for Rehabilitation of Manual Scavengers (SRMS)

- Stand Up India Scheme

2. Livelihood Loan

Only one scheme ( Deendayal Antyodaya Yojana – National Rural Livelihoods Mission (DAY-NRLM)is currently enrolled under this loan category. The primary focus for facilitating this ` loan is to reduce poverty by catering financial assistance to the poor, especially women, enabling them to avail themselves of an extensive array of financial institutions or credit scheme options.

3. Agri-Infrastructure Loan

This section of credit schemes can be availed for post-harvest maintenance and agriculture consulting. Loans are granted to promote the development of the agricultural infrastructure of the economy; for instance, funds are provided for the construction of clinics and commercial centers related to agricultural activities.

Three schemes have been made available under this category:

- Agri Clinics and Agri-Business Centers Scheme (ACABC)

- Agricultural Marketing Infrastructure (AMI)

- Agriculture Infrastructure Fund (AIF)

4. Education Loan

Loans are granted for pursuing studies in India or even outside India. The funds are granted for almost all courses to impart quality education among the nation, especially to the poor.

Three schemes have been made available under this category:

- Central Sector Interest Subsidy (CSIS)

- Padho Pardesh

- Dr. Ambedkar Central Sector Scheme

Jan Samarth FAQs:

1.How can one apply for the schemes at the Jan Samarth Portal?

You must first check eligibility for your desired loan category by answering a few easy questions. If you are qualified under any of the schemes, you may choose to apply online to get digital approval.

2.How to register for Jan Samarth Portal?

The fundamental papers necessary to apply online on the Portal are Aadhaar Number, Voter ID, PAN, Bank Statements, and so on. On the portal, the candidate must also enter some basic information.

3.Can I make changes to the application in Jan Samarth Portal?

No modifications may be made once an applicant applies and submits the loan application form.

4.Is it possible to apply for more than one loan at Jan Samarth Portal?

Yes, as long as one is qualified for the particular credit scheme. The applicant can apply for more than one credit scheme. However, confirmation can be subject to terms and conditions.

5.How long will it take to get my application approved in Jan Samarth Portal?

The portal processes the application faster than the traditional way of approving loans. However, the application can take one to two days to confirm the loan.

6.Why did my Jan Samarth registration get cancelled?

The registration cancellation may be due to an incomplete application or due to some incorrect information filled in the application. Hence, we advise you to fill in only authenticated information.

7.How many lenders are available at the Jan Samarth Portal?

The recipient can compare offers from over 125 lenders and receive digital clearance from a selected bank.

8.In case of grievances, what are the options available to the borrowers?

The borrowers can email at grievance@jansamarth.in or contact at 79690-76111.

9.In case of grievances, what are the options available to the bankers?

The borrowers can email at Bank.support@jansamarth.in or contact at 79690-76123

10.How many language options can I access the Jan Samarth Portal?

The portal can be accessed in English, Hindi, Marathi, Bengali, Telugu, Gujarati, and Asami.

11. How to Track your Business Loan Application?

The applicant can monitor the status of their loan application on the centralized web portal. For this, log in with your official registration credentials and navigate to the dashboard’s My Applications tab to see the status of your applications

(To gain an insight on value added information for MSMEs ,Startups follow MSMETALK on Linkedin, Instagram, Facebook,Twitter. Also, don’t miss our podcast, on which we bring experts from the Industry to give value addition guidance to scaleup and build long lasting business through informative topics)