Blog 6-Collateral Free Loans for Women Entrepreneurs

Without access to financial resources, property or an adequate credit history, for many women entrepreneurs the bank used to be the edge of the road . And, there also, the loan used to get rejected because of lack of collateral. However, now the Government of India has devised various financial schemes to give our women the required financial push, that too without requiring any collateral.

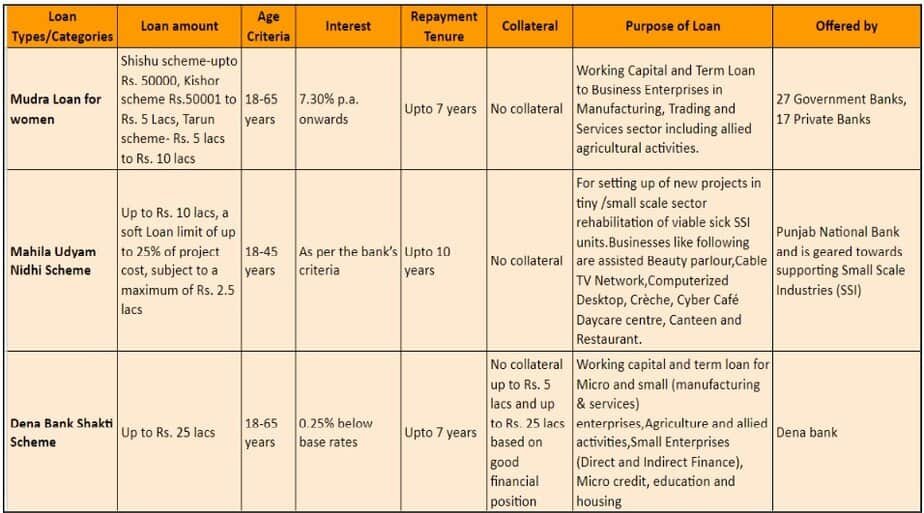

In this blog, we have discussed various loan options available for women entrepreneurs without mortgaging any collateral along with the age criteria, purpose of loans, and the banks offering it.

Follow MSME TALK LinkedIn

Did You Know?

Based on the Sixth Economic Census published in 2018, women make up approximately 14% of total entrepreneurs. Although the numbers might not be that stunning when you read them in percentage, this is 8.05 million female entrepreneurs.

In the last couple of decades, Women-owned business start-ups have picked up a lot of acceptance and popularity in the country. Be it service sector or manufacturing sector, emergence of women-owned businesses is making a huge contribution towards the country’s economic development.

But, despite of all this, women are still discouraged by lack of funding and have to struggle a lot to get business funding because of lack of collateral security.

(Subscribe for alerts to stay updated with launch of new podcast episodes and blogs about MSMEs & Startups)

A collateral-free loan or an unsecured business loan is a loan where you can borrow the funds at a fixed rate of interest even when you do not have any asset or collateral to pledge.

(Follow MSME TALK podcast, where we bring experts from the Industry to give value addition guidance, to scaleup and build long lasting business)

A recent survey by one of the ecosystem-lending platforms for MSMEs, Indifi Technologies, has revealed that the biggest challenge women entrepreneurs face is in securing capital to run a business, followed by managing business operations, and securing a credit period from vendors/suppliers.It found that starting and scaling up the business is difficult for women SMEs, with raising the requisite capital being the common challenge in each stage.

Hence, the Government of India has come up with various financial schemes specially for women entrepreneurs, which would help them to setup any new business or to expand an existing unit.

There are several schemes and loan options available without mortgaging any collateral.

These loans come with a lot of benefits like minimal documentation, No collateral, longer repayment period and nominal interest rates

(MSMEs , do you know the delay in payments for the goods supplied by you would invite heavy penalty against defaulting buyers? To know about such Govt. Provisions, read our blog-Delayed payments -Why is Sec 15 of MSMED ACT so important for MSMEs?)

Here are some attractive loan options available for the women entrepreneurs:

These financial schemes give our women the required financial assistance, that too without requiring any collateral; whether it is for starting a new business or expanding an existing unit, there are several schemes and loan options available.

(Follow MSME TALK on Linkedin, Instagram, Facebook,Twitter)

These schemes helps women in expanding to new markets, streamlining their production processes, do away with the cash-flow disruptions and also solves many of the traditional disadvantages faced by women entrepreneurs in India.

These were some of the small business collateral loans for women which can provide funding to your business at minimal eligibility requirement currently in India that too at an affordable interest rate. While women business owners have no shortfall of ideas and ambition, it is usually the funding that is the weak spot.

So now, all you need is to bring your business ideas to life by using the scheme that best suits your requirement.

(Also, don’t miss our podcast, on which we bring experts from the Industry to give value addition guidance to scaleup and build long lasting business through informative topics)

If you would like to nominate someone for 100% sponsored 8 weeks International Mental Fitness program used by Global CEOs & MNCs to 1 woman entrepreneur [ Cost ~ INR 1 lakh ] , please ask to fill below form.

Link for the Mental Fitness program Form