Contents

ToggleBlog 7- What MSMEs have received from Budget 2023-24?

MSMEs have played a key role in promoting entrepreneurship and fostering innovation in India. They have helped to create a culture of innovation and risk-taking, which has led to the emergence of new and innovative products and services in various sectors. Considering the same, Government has come up with various steps to promote MSMEs and startup in Budget 2023.

MSMEs are critical to India’s economic growth and development, and the government has come up with various schemes for MSMEs from time to time to promote their growth and development. These include initiatives such as the ‘Make in India’ campaign, the MSE CDP Programme and the National Skill Development Mission, and many others which aim to provide support and incentives to MSMEs and small business entrepreneurs and further promote their competitiveness in the global marketplace.

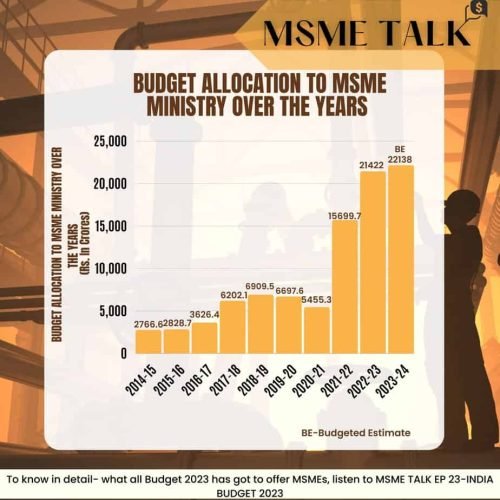

MSME in Budget 2022 were allotted ₹21422 crore. Now, let us have a look at Budget 2023, and see what all it has brought for msmes, startups and business entrepreneurs.

The government has proposed to expend a whopping ₹22,138 crore on allocations aimed at the micro, small, and medium enterprises (MSMEs) ministry in the Budget 2023-24, which will play an instrumental role in employment generation in the country.

(Follow MSME TALK podcast, where we bring experts from the Industry to give value addition guidance, to scaleup and build long lasting business)

1. Infusion of Rs 9,000 crore into the credit guarantee scheme under CGTMSE

CGTMSE stands for Credit Guarantee Fund Trust for Micro and Small Enterprises. It is a scheme introduced by the Government of India to provide collateral-free credit facilities to Micro and Small Enterprises (MSEs).

CGTMSE provides credit guarantee cover to member lending institutions such as banks, financial institutions, and non-banking financial companies (NBFCs). The guarantee cover extends up to a certain percentage of the credit facility provided by the lending institution, in case of default by the borrower.

CGTMSE gives guarantee to its MLIs Member Lending Institutions. Therefore, entrepreneurs in the Micro and Small Enterprises sector have to approach the Banks or financial institutions (who have already registered with the Trust as MLIs) with their viable proposals for their credit requirements.The List of MLIs of the Trust can be seen at CGTMSE web-site

(To know in detail, what all Budget 2023 has got to offer MSMEs, listen to MSME TALK EP 23-INDIA BUDGET 2023)

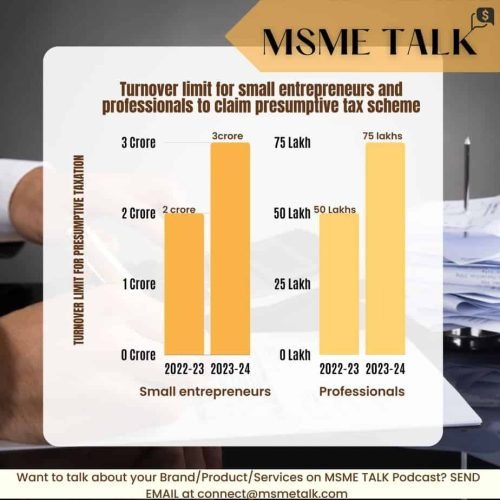

2. Threshold limits for presumptive taxation schemes Increased

Under presumptive taxation, a relief is provided to small entrepreneurs and professionals, wherein they are not required to maintain their books of account and get their accounts audited

Earlier the turnover limit for small entrepreneurs and professionals to opt for presumptive taxation was Rs.2 Crore and Rs 50 lakhs respectively, which has now increased to Rs 3 crore and Rs. 75 Lakhs respectively, provided their cash receipts are not more than 5 per cent of total receipts

3. Addressing payment issue of the MSMEs

In msme budget 2023 highlights, the finance minister has come up with an important amendment to section 43B of the Income Tax Act, 1961 to ensure the timely payments to the MSMEs, which has always remained a biggest challenge for MSMEs.

Here, a new clause (h) is proposed to be inserted in section 43B of the Act to provide that any sum payable by the assessee to a MSMEs beyond the time limit specified in section 15 of the MSMED ACT, 2006 shall be allowed as a deduction only on actual payment.

So, if the payments are not being made to MSMEs as per section 15, then such amount cannot not be claimed as an expenditure the way it used to be earlier.

(If you want to know more about Sec 15 of MSMED ACT, read our blog –Why is Sec 15 of MSMED ACT so important for MSMEs?)

Deductions of such payment would only be allowed, only when actually paid.

Section 15 of the MSMED Act mandates payments to MSMEs within the time as per the written agreement, which cannot be more than 45 days. If there is no such written agreement, the section mandates that the payment shall be made within 15 days.

It will definitely ensure that MSMEs receive their payments on time and help in their cash flows.

4. ‘Vivad se Vishwas-I’ scheme- 95% of the forfeited amount of performance guarantee and bid security during the Covid period will be returned to MSMEs

As we all know that pandemic had a huge impact on every aspect of our economy and thereby MSMEs were also not spared.

So, in order to reinstate one of the major employment provider industry, i.e MSMEs, in MSME budget 2022-23, Finance minister announced ‘Vivad se Vishwas-I’ scheme which provides that in cases where msme failed to execute contracts during the Covid period, 95% of the forfeited amount relating to bid or performance security will be returned to them by government and government undertakings.

(Follow MSME TALK LinkedIn)

Criteria:

- The contractor should be registered as a medium, small or Micro enterprise with Ministry of MSME as on March 31, 2022

- The original delivery period/completion period was between Feb 19, 2022 and Mar 31, 2022

5. Tax benefits to start-ups which are incorporated up till March 31, 2024

The startups which have an inter-ministerial board certificate could avail the exemption from income tax for 3 consecutive years out of 10 years. since incorporation. Such startups were eligible for the tax exemption, only if they were incorporated before April 2023.

Now, with the 2023 budget announcement, finance minister has extended this period of incorporation by another year.i.e April 2024 so the tax incentives could be offered to more number of startups in the country.

6. Relief to Start-ups in Carry forward/ Set-off of Losses

The startups have been given a relief in carrying forward and setting of losses.

Earlier, eligible startups were allowed to carry forward and set off losses if a such loss has been incurred for seven years beginning from the year in which the company was incorporated.

The minister said startups would be allowed to carry forward losses under section 79 to ten years from the current seven years.

7. Digilocker for MSMEs

Finance minister has announced plans to set up DigiLockers for the MSMEs along with large businesses and charitable trusts.

Government has already taken many steps towards realising the goal of Digital India mission. Like Unified Payment Interface (UPI), Aadhar, Common Services Centres, Unified Mobile Application for New-age Governance (UMANG)

Now to further giving it a push, the Finance Minister has come up with DIgiLockers for the MSMEs

(Also, Do not miss MSMETALK Podcast, on which we bring experts from the Industry to give value addition guidance to scaleup and build long lasting business through informative topics)

“An Entity DigiLocker will be set up for use by MSMEs, large business and charitable trusts. This will be towards storing and sharing documents online securely, whenever needed, with various authorities, regulators, banks and other business entity” FM said in her budget speech.

This will definitely speed up the realisation of the digital transformation goal of the country.

MSME TALK is a business podcast for MSMEs and Startups on which Industry Experts are invited to discuss one specific topic and published across all major platforms like Apple, Spotify,Google, Gaana etc.

To talk about your product or services for MSMEs on MSME TALK Podcast, send email at connect@msmetalk.com

(To know in detail, what all Budget 2023 has got to offer MSMEs, listen to MSME TALK EP 23-INDIA BUDGET 2023)