Contents

ToggleCGTMSE Scheme: A Government scheme empowering Micro and Small Enterprises with Collateral-Free Credit

What is the CGTMSE Scheme?

Credit Guarantee refers to a situation where the loan to the applicant is backed by a party without the need for any external collateral or third-party guarantee.

So, basically, the credit guarantee scheme is a form of loan insurance that facilitates access to credit for micro and small enterprises (MSE) by providing credit guarantees to financial institutions – making it easier for businesses to avail of credit facilities without providing collateral security or third-party guarantees.The scheme focuses on Financial empowerment for businesses

Here in CGTMSE Scheme, the loan sanctioned by the member lending institution is backed by this scheme which provides the guarantee cover for a large portion of the loan amount dispersed to the MSEs.

Both new and existing micro and small enterprises, including manufacturing and service enterprises are eligible for a credit facility of up to Rs. 5 crores.

These credit facilities encompass various types of loans, such as term loans, working capital loans, composite loans, and other credit facilities tailored for micro and small enterprises. It ensures that MSEs have the necessary financial security and support throughout the specified duration of their credit facility.

(Follow MSME TALK podcast on your favourite podcast platform, where we bring experts from the Industry to give value addition guidance, to scaleup and build long lasting business)

MSEs Definition

Micro Enterprises are those, wherein the investment in plant and machinery equipment is not more than 1 crore, and annual turnover is not more than 5 crores and Small Enterprises are the ones wherein the investment in plant and machinery equipment is not more than 10 crores, and annual turnover is not more than 50 crores.

The scheme is spearheaded by the Government of India, overseen by the Ministry of Micro, Small and Medium Enterprises (MoMSME), and administered by the Small Industries Development Bank of India (SIDBI). Its main objective is to promote the growth and development of medium and small enterprises by mitigating the lending risks associated with these enterprises.

(If you are an Industry Expert, then Share about your expertise with us on MSMETALK Podcast)

Benefits of the CGTMSE Scheme for MSEs

There are numerous benefits that you as a borrower can enjoy from MSE loans under the scheme. Let’s look at what those are so that you know what’s potentially in store for you and how you can benefit.

- Enhance credit flow: The scheme aims to boost credit accessibility for Micro and Small Enterprises (MSEs) by offering a credit guarantee cover to mitigate default risks. This helps MSEs secure vital funds for daily operations and investments, fostering their financial stability and growth.

- Collateral-free loans: Medium and small enterprises can avail loans without needing collateral or third-party guarantees.

- Risk mitigation: Reduces risk for financial institutes by providing them with credit guarantees when they lend to medium and small enterprises.

- Entrepreneurship encouragement: Promotes entrepreneurship and business activity among medium and small enterprises.

- Encourages lending: Financial institutions, both banks and non-bank financial institutions, are encouraged to lend to medium and small enterprises by guaranteeing coverage.

- Lower guarantee fee: The one-time payment made by the borrower under the scheme is charged at a low rate – typically 1.50% annually based on the outstanding balance. This reduces the overall cost of borrowing.

- Easy repayment terms and no pre-payment penalties: Provides borrowers with greater control, cost savings, and flexibility in managing their loans.

(Subscribe for alerts to stay updated with launch of new podcast episodes and blogs about MSMEs & Startups)

Eligibility criteria

To access this loan, you must first qualify as an eligible borrower. Refer to the list below to see if you qualify.

Eligible borrowers

- Existing and new Medium & Small Enterprises (MSEs) engaged in manufacturing or service activity. (Definition of MSE given above in this blog).

- Exclusion:

- Self-help groups (SHGs)

- Educational Institutions

- Agriculture

- Training institutions

However, keep in mind that the eligibility criteria for borrowers may vary depending on the lending institution’s policies and the nature of the loan. Therefore, it’s best to check with the specific lending institution or consult their guidelines to determine the typical age requirements for borrowers.

Member Lending Institutions (MLIs) offering loans under CGTSME

- Regional Rural Banks (RRBs)

- Scheduled Commercial Banks (SCBs)

- Small Finance Banks (SFBs)

- Non-banking Financial Companies (NBFCs)

- Small Industrial Development Bank of India (SIDBI)

- National Small Industries Corporation (NSIC) and

- North Eastern Development Finance Corporation Ltd. (NEDFi)

- Micro-Finance Institutions

(MSME TALK podcast is available across all major platforms like Apple Podcast, Spotify, Google Podcast, Gaana Podcast , Amazon Podcast, Jio Saavan)

CGTMSE Scheme: Coverage and extent of the Guarantee

Before diving right in, you need to know what precisely a guarantee coverage means –that we have already covered at the start of the blog.

With that explained, let’s take a look at the features including coverage and extent of the scheme.

(Subscribe for alerts to stay updated with launch of new podcast episodes and blogs about MSMEs & Startups)

The loan amount limit may also vary depending on the applicants’ profile and business requirements. On top of that the coverage doesn’t include additional charges such as penal interest, commitment charges, service charges, or any other fees or expenses.

For more details on the CGTSME loan scheme, refer to their website for additional information.

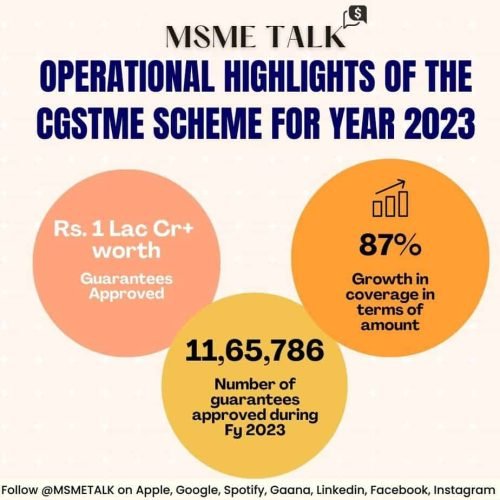

The government’s Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE), has surpassed Rs 1.50 lakh crore worth of guaranteed amount in the current financial year in comparison to Rs 1.04 lakh crore in FY23, increasing sharply by 50 per cent.

-Financial express Feb 09, 2024

How to apply for the CGTMSE guarantee

By now, you might be wondering how to apply, well, we’ve got you covered. You can access credit facilities when you apply for the linked loans under the scheme. Here are the steps to secure a loan from the lender:

Documents required

The first and most significant step is to prepare the required documents to secure a loan from a financial institution that is covered under CGTMSE:

- Loan application form: Details filled in accompanied by a passport-size photograph.

- Identity proof: PAN card, Aadhaar card, passport, voter ID, or driving license for establishing the applicant’s identity.

- Business registration documents: Examples are business incorporation certificate, company registration certificate or partnership deed.

- Business project report: Describes the purpose of the loan, the amount required, utilisation plans, and expected outcomes.

- Financial statements: Financial documents such as balance sheets, profit and loss statements, cash flow statements, audited financial statements, bank statements, and income tax returns for the past few years.

- Collateral documents: Relevant documents such as property papers, title deeds, mortgage documents, or any other security-related documents.

Do note that the documents may vary depending on the lending institution’s requirements. Therefore, we recommend checking in with the respective bank or financial institution for a complete list of required documents.

(Adopting Circular Economy ideas can help businesses to grow exponentially, want to know how? Listen to MSME TALK latest Episode #31 Circular Economy and MSMEs Ft. Siddharth Lulla, Principal- Intellecap)

Enrolment procedure

Follow step-by-step process, which will help guide you through the loan application process as shown below:

- Establishment of the business entity: You must establish a business entity. Additionally, you’ll need to acquire the required approvals and tax registrations to proceed with the project.

- Creating a business project report: Create a comprehensive business report that clearly defines the project’s components. The report should contain the following relevant information:

- Business model

- Promoter profile

- Projected financials

- Selection of the lender bank: After the business model is constructed, the decision regarding which lender bank to approach is to be taken. Once that is done the application along with the business model is to be submitted to the bank.

- Loan sanction from the bank: Once the application form has been successfully submitted, processing takes place. At this stage, banks will assess the application viability, process the application, and sanction the loan per the lender’s policy.

- Obtaining guarantee cover: After sanctioning the loan, the lender’s due diligence is to apply for the guarantee cover. Once it’s approved, you must settle the guarantee fee and service charges.

After the approval comes through, to avail of coverage for their loan under the credit guarantee fund scheme, the business will have to pay CGTMSE guarantee and service fee on top of the interest rate set by the bank as per RBI’s guidelines.

(If you are planning to start an export business, then this blog Capacity Building of First Time Exporters (CBFTE) Scheme: A Government Scheme for Entry-Level Exporters is for you)

What is the CGTMSE Fee?

The revised Annual Guarantee Fee (AGF) structure under the Credit Guarantee Scheme, applicable to all guarantees approved or renewed on or after April 01, 2023, is provided below:

*AGF(annual guarantee fee/Standard rate per annum) will be charged on the guaranteed amount for the first year and on the outstanding amount for the remaining tenure of the credit facility.

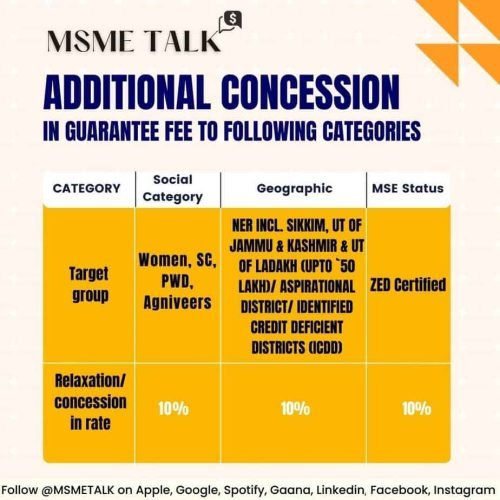

Member Lending Institutions (MLIs) that maintain a better portfolio will receive a 10% discount on the standard rate whereas MLIs with high risk associated would be charged maximum risk premium upto 70% of standard rate.

Claim settlement procedure

A claim settlement procedure ensures a smooth process for lenders to recover outstanding amounts when borrowers default on their loans to safeguard lenders against financial losses.

Once the final instalment of the loan amount is disbursed, there’s a lock-in period of 18 months, during which the lender can make a preferred claim for the CGTSME scheme when an account becomes a non-performing asset (NPA). A non-performing asset (NPA) refers to a loan or credit facility that is in default or shows signs of being at risk of default.

(If your offerings cater to the needs of MSMEs and Startups, seize the chance to be featured on our platform! Join our Waiting List to showcase your Products and Services on MSME TALK website)

Changes brought to CGTMSE Scheme 2023

Nirmala Sitharaman, Finance Minister of India, in her budget 2023 speech, announced the changes for the credit guarantee scheme.

The changes are as follows:

- Rs 9,000 crore will be infused into the corpus of the CGTMSE scheme, effective from April 1, 2023.

- Additional collateral-free credit of Rs 2 lakh crore will be available for MSEsin the next three

- The cost of credit will be reduced by 1%.

- MSEs seeking guarantee cover under the scheme for collateral-free credit will have to provide their Udyam Registration Number (URN).

- Microfinance Institutions (MFIs) will be added to the member lending institutions (MLIs) list.

Small and Micro-Enterprises owned and/or operated by Women Entrepreneurs are eligible for a Guarantee Cover of 80%, whereas all the credit/loans in the North East Region (NER) for credit facilities are eligible for a guarantee of Rs. 50 lakh.

(If you want to know how innovative startups championing preventive healthcare industry, and also want to learn about the opportunities preventive healthcare industry brings for new entrants, read MSME TALK’s Blog- Preventive healthcare: Potential future of Indian Healthcare Industry)

FAQs

- Is it mandatory for an eligible borrower to obtain all the necessary credit facilities from a single institution?

- Borrowers can receive credit facilities from multiple lenders, either jointly or separately, as long as the total amount does not exceed the maximum limit of 500 lakhs per borrower, subject to the individual limit set by the lending institution or as specified by the Trust. However, it is important to note that sharing of securities will not be allowed.

- When will the guarantee cover commence for the eligible credit facility?

- The guarantee cover will commence from the date on which guarantee fee proceeds are credited to bank account of the Trust.

- How long the guarantee cover is available for credit facilities extended to a particular borrower?

- Guarantee will commence from guarantee start date and shall run through the agreed tenure of the term loan / composite loans. Where working capital facilities alone are extended to eligible borrowers, it would be for a period of 5 years or block of 5 years on renewal of the guarantee cover, provided MLI pays the Annual Service Fee due as on March 31, latest by within 60 days from the date of demand by CGTMSE or such date as specified by the Trust.

- What is the tenure of the cover for credit relating to working capital?

- The tenure for coverage of working capital facilities is 5 years, where working capital alone is covered under the scheme. In case term credit and working capital both are covered under the scheme, the tenure relating to working capital facility would match the normal repayment period of term credit. The reason for keeping a limit of 5 years wherever working capital alone covered are that the period for which the same are extended by the lending institutions are not time bound. The same are reviewed periodically for increase/ decrease in the limit sanctioned, and are expected to continue for a time frame much longer than 5 years. CGTMSE welcomes any renewal of guarantee cover beyond 5 years on a payment of applicable guarantee fee.

- When can the lender invoke the guarantee given by the Trust in respect of credit facility advanced by it to the eligible borrower?

- The lender shall prefer a claim on the defaulted account on recall of loan and initiation of recovery proceedings under due process of Law. The lender can, however, invoke the guarantee given by the Trust only after the lock-in period of 18 months (or 9 months for guarantee upto ₹ 10 lakh with tenure upto 36 months) either from the date of last disbursement of credit to the borrower or from the date of the guarantee cover coming into force in respect of the particular credit facility, whichever is later.

- Are borrowers from all service sector enterprises eligible under the CGTMSE Scheme?

- All service sector activities, as defined by the MSMED Act of 2006, are eligible for coverage under the scheme.

- What is the lock-in period in CGTMSE?

- The lock-in period in CGTMSE is for 18 months.

- Which institutions are eligible to offer loans under this scheme?

- All scheduled MLIs, including PSUs, private and foreign banks in addition to selected regional and rural banks and any other bank directed by the Government of India can avail the guarantee cover under the scheme.

- Is Mudra loan covered under the scheme?

- No, the Mudra loan is not covered under the CGTMSE scheme.

- When can the eligible lending institutions apply for guarantee cover in respect of eligible credit facilities under the scheme?

- Eligible lending institutions have to enter into a one-time agreement with CGTMSE for becoming MLIs of the trust. MLIs then can apply for a guarantee cover in respect of the eligible credit facility sanctioned to an eligible borrower. The MLIs can apply for a guarantee cover in respect of the credit proposals sanctioned in the quarter of April-June, July-September, October-December, and January-March before the quarter ends.

- Are small road transporters and water transporters eligible for cover under the scheme?

- Yes, they are. Small road and water transport loans that are approved by MLIs are eligible for cover under this scheme. All small business owners in this industry who are seeking a loan can request the lender to add the CGTMSE cover to their loan applications.

- Is it compulsory for the borrower to obtain IT-PAN to become an eligible borrower?

- Yes, the borrower is required to obtain IT-PAN before availing facility from the MLI. Also, under section 139A(5) and section 272C of the Income Tax Act, 1961.

- Is it necessary for the borrower to obtain all the credit facilities from a single MLI?

- Credit facilities can be extended through more than one MLI jointly and/or separately to any eligible borrower with a maximum cap of Rs. 200 lakh per borrower.

- Is co-financing with a commercial bank covered under the CGTMSE scheme?

- Joint financing by a financing institution and a commercial bank can be covered under the scheme. For instance, an MSE unit can borrow through a term loan from a state financial institution and take working capital funding from a commercial bank.

- Can term loan or working capital alone be extended by an eligible lender and still be covered under the guarantee scheme?

- Any eligible lender can extend either a term loan or working capital facility alone and still be eligible for the guarantee cover under the scheme.

- Can the annual guarantee fee be paid even after the lodgment of the claim?

- Annual guarantee fee can be paid even after the lodging of the claim but it has to be settled before the first installment of 75% of the guaranteed amount. However, one cannot lodge any claim before the expiry of the initial lock-in period and after the expiry of the tenure of guarantee cover.

(MSME TALK podcast available across all major platforms like Apple Podcast, Spotify, Google Podcast,Gaana Podcast, Amazon Podcast, Jio Saavan)