Contents

ToggleBeyond the Balance Sheet: How Intangibles Shape True Business Value

In this blog, author Vinay Pandya, Managing Partner, Mantraa Advisory explains that there are many things that make a business valuable, but still can’t be seen on a balance sheet. Brand trust, customer loyalty, reputation, and promoter credibility play a big role in how businesses are valued today—especially in India. This blog explains how such intangible assets help companies grow, build trust, and attract better valuations. Using examples like Bisleri, Colgate, and Zandu, it shows how these hidden strengths matter more than ever. It also highlights how ignoring them, like in the case of Videocon, can lead to lost value.

About the Author

Vinay Pandya is the Managing Partner at Mantraa Advisory and a seasoned professional with qualifications as a CA, CS and Registered Valuer. With over two decades of experience, he works closely with businesses on valuation, fundraising, mergers and acquisitions, and strategic planning. Vinay believes that a company’s true value often lies in what can’t be seen — like brand trust, customer relationships, and legacy.

Introduction: Videocon and valuation lost

In today’s economy, the real levers of value aren’t always visible on financial statements. From global tech giants to India’s household names, intangible assets now dominate enterprise value—be it brand trust, proprietary technology, or loyal customer relationships. These are not just abstract ideas — they’re powerful drivers of long-term business success and premium valuation.

Yet, traditional metrics like price-to-earnings or book value often overlook these invisible drivers. As a result, many founders and early-stage investors miss critical factors that shape long-term growth and resilience.

Take Videocon. Despite its deep brand recognition and proprietary technologies, these intangible assets were undervalued or ignored during its insolvency process. The outcome? A massive destruction of potential value—for creditors, acquirers, and the broader ecosystem.

This blog explores how intangibles, especially qualitative ones, play a vital role in how businesses are valued — and why ignoring them can mean missing the full picture.

(Are you a business or expert serving MSMEs and startups? Spotlight your services and expertise – partner with MSME TALK to create podcasts, blogs, listings, and social media content that truly reach and inspire!)

What Is Valuation? Understanding the Tangible vs. Intangible Divide

At its core, valuation is the process of estimating the economic worth of a business, asset, or company segment. Traditional valuation methods tend to focus on tangible assets—physical infrastructure, machinery, inventory, and earnings—using models like discounted cash flow (DCF), comparable company analysis, or asset-based approaches.

But in today’s innovation-led economy, a significant portion of value lies in intangible assets—elements that are not easily captured by financial statements. These include brand equity, intellectual property, customer loyalty, innovation capacity, and organizational culture.

Unlike tangible assets, intangibles derive their value from future potential, relationships, and perceptions. Their influence on long-term cash flows is real, but their measurement is often subjective or indirect.

This complexity is why modern valuation professionals blend quantitative techniques with qualitative analysis, providing a more holistic picture of a business’s true value. Hence there are certified Valuers for Business Valuation

(Don’t miss MSME TALK special MSME Day 2025 episode of Industry Insights — featuring expert voices from EV, semiconductors, invoice discounting, and circular economy sectors)

Why Qualitative Intangibles Matter More Than Ever for Higher Business Valuation

In India, many businesses—especially MSMEs and family-owned enterprises—have built their success not just on assets and balance sheets, but on relationships, reputation, resilience, and legacy. These are classic intangibles, and yet they’re often underestimated or ignored in formal valuations.

- Brand Familiarity as a Market Moat

Indian consumers place enormous trust in familiar, longstanding brands. Whether it’s a household toothpaste or a trusted ayurvedic balm, the emotional connection with legacy brands translates into sustained demand. Many such businesses may lack visible marketing assets or digital infrastructure—but their brand recall and rural reach are unmatched. This we are seeing in the Spice sector in last few years how regional know brands are getting bought over at high valuation.

- Relationship Capital & Distribution Networks

In India’s complex and fragmented supply chains, the strength of personal relationships with distributors, stockists, and channel partners often defines market access. These informal networks function as a significant intangible advantage, especially in Tier 2–4 markets.

- Promoter Trust & Legacy Reputation

For many unlisted companies, the reputation of the promoter is a key intangible driver. Investors and customers alike make decisions based on a founder’s credibility, ethics, and track record—factors that don’t show up on financial statements but hold immense value.

- Embedded Knowledge and Indigenous Innovation

Many traditional businesses have built process innovations, formulations, or manufacturing techniques passed down through generations. These may not be patented or documented but represent deep intellectual capital—what we often refer to as “tribal knowledge.”

- Underserved Yet High-Potential Sectors

Industries like Ayurveda, regional foods, vernacular content, and niche manufacturing have high intangible value but remain undervalued due to lack of formal IP protection or digital visibility. Yet, these are the very sectors where brand authenticity, cultural alignment, and trust are strategic differentiators.

In short, the Indian business landscape is rich with intangibles—but poor in how it formally captures or leverages them. As investors and founders look toward unlocking real value, especially in growth or succession planning, recognizing and investing in these invisible assets will be key to sustainable valuation.

Which Qualitative Intangibles Drive Business Value

Intangible assets aren’t just passive support systems—they are active engines of enterprise value. Their influence spans across customer behavior, competitive advantage, operational performance, and risk management.

- Brand Equity & Reputation

A strong brand creates pricing power, lowers customer churn, and builds emotional connection. It acts as a defensive moat, especially in commoditized markets.

- Customer Trust & Loyalty

Trust built through consistent product quality and ethical behavior encourages repeat business and advocacy. This leads to predictable revenue streams and lower marketing costs.

- Technological Capability & IP

Ownership of proprietary platforms, patents, or unique formulations creates barriers to entry and enables access to new market segments and revenue models.

- Human Capital & Organizational Culture

Engaged, skilled teams embedded in a mission-driven culture accelerate innovation, improve execution, and elevate service standards—ultimately translating into financial returns.

- Strategic Governance

Sound governance ensures that intangible strengths—be it brand, IP, or relationships—are systematically leveraged, protected, and aligned with growth strategy.

- Strategic Relationships

Enduring partnerships with vendors, distributors, and institutions enhance business continuity, reduce dependency risks, and create access to new markets or capabilities. These relationships, often serve as invisible scaffolding that supports long-term strategic advantage.

- Innovation Culture

A mindset of adaptability and continuous problem-solving drives faster response to market changes and evolving customer needs. When innovation is embedded in culture—not just confined to R&D—it becomes a consistent source of differentiation and future revenue potential.

- Purpose and Mission Alignment

A clearly defined purpose that resonates across teams and customers cultivates trust, loyalty, and brand distinctiveness. This alignment often translates into stronger stakeholder relationships, better decision-making, and long-term value creation beyond short-term profitability.

- Sustainability and Purpose-Led Narratives

Increasingly, stakeholders value companies with authentic ESG commitments, clean practices, and purpose-led missions. These qualities foster customer loyalty, attract conscious capital, and help businesses win trust across generations.

Together, these intangible levers reduce business risk, enhance scalability, and often result in higher valuation multiples or discounted cash flow estimates. In brand-led and technology-intensive businesses, these assets can represent the majority of enterprise value—even if they’re nowhere to be found on a balance sheet.

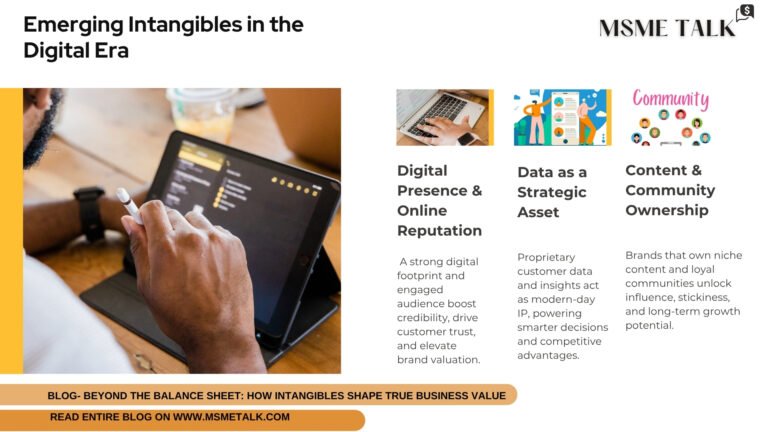

Emerging Intangibles in the Digital Era

As the economy shifts from industrial to digital, the nature of intangible assets is also evolving. It’s no longer just about brand and goodwill — today’s businesses are valued for assets that barely existed a decade ago.

- Digital Presence and Online Reputation

A brand’s online visibility, customer reviews, social media presence, and engagement levels now directly influence customer perception and valuation. Businesses with high follower loyalty, strong D2C platforms, or viral content enjoy value multipliers far beyond their asset base.

- Data as a Strategic Asset

Customer data, behavioral insights, and proprietary algorithms are becoming the new intellectual property. Companies that gather, organize, and leverage data — responsibly — can create defensible business models and predictive advantages that enhance long-term value.

- Content & Community Ownership

Brands that build communities — whether through newsletters, educational content, or creator-led ecosystems — are creating intangible influence that drives loyalty. Ownership of niche audiences can be a valuation lever, especially for newer businesses.

In the digital era, the “invisible” has become a strategic edge — and investors are learning to price these new-age intangibles alongside traditional valuation metrics.

Intangibles on the Balance Sheet: What They’re Really Worth

- Enterprise Value Composition: According to an EY India survey covering 750+ M&A deals through March 2024, 28% of deal value was allocated to identified intangible assets and 35% to goodwill. That means together, intangibles made up over 60% of value in many transactions.

- Sector Value Variability: Consumer sectors (FMCG, retail), life sciences, and IT saw higher intangible allocation; capital-intensive segments like infrastructure or hospitality leaned more toward tangible assets.

- Valuation Multiples: Indian SaaS startups with strong proprietary platforms attracted multiples that were roughly 1.5× to 2× higher than service-based peers, reflecting recognition of technology-driven intangibles.

- Investor Perception: Firms with robust intangible assets generally exhibit more stable earnings and growth trajectories, which lead to higher investor confidence and lower risk premiums in valuation models.

How Colgate, Zandu, Bisleri riding strong Intangible Valuation

Let’s explore how well-known Indian brands enjoying higher Business Valuation leveraged by Intangibles often without significant changes in their tangible asset base.

Bisleri – Trust in a Bottle

Key Intangibles: Brand Trust | Perceived Safety | Ubiquity | Visual Identity

Invisible Value Driver: Trust equity built through familiarity and nationwide visibility.

Bisleri turned a basic commodity — water — into a market leader through trust, packaging consistency, and brand recall. While competitors offer similar quality at lower prices, Bisleri’s perceived safety, consistent packaging, and brand familiarity create a moat. Its valuation reflects these emotional moats. Its reputation as the “safe choice” is a deeply ingrained perception, not built overnight but through years of consistent positioning — a qualitative intangible that drives repeat purchase.

Impact on Valuation:

- High Goodwill Value: A large portion of Bisleri’s valuation is brand-driven; the proposed acquisition by Tata valued it at around ₹7,000 crore.

- Resilient Revenue Streams: Trust ensures consistent demand even during pricing fluctuations.

- Premium Positioning: Able to charge more than generic brands, which supports strong margins and brand-based valuation multiples.

Colgate-Palmolive India – A Household Name

Key Intangibles: Habit Formation | Generational Recall(Brand Loyalty) | Educational Advocacy

Invisible Value Driver: Deep emotional and behavioral connection built over decades.

For decades, Colgate has been synonymous with toothpaste in Indian households. It built this dominance not just through distribution, but through deep-rooted brand trust, generational recall, and educational campaigns like Oral Health Month. Its balance sheet may show factories and inventory — but its real strength lies in customer habit and loyalty. Colgate is more than a product — it’s a default choice, often used as a generic name for toothpaste.

Impact on Valuation:

- Higher P/E Multiples: Trades at 30x+ earnings due to strong consumer trust and consistent financials.

- Stable Cash Flows: Predictable demand and low customer churn reduce investment risk.

- Strong Goodwill: Much of its enterprise value is derived from brand equity, not tangible assets

(Are you a business or expert serving MSMEs and startups? Spotlight your services and expertise – partner with MSME TALK to create podcasts, blogs, listings, and social media content that truly reach and inspire!)

Zandu – Ayurveda Powered by Legacy and Trust

Key Intangibles: Cultural Resonance | Legacy Reputation | Traditional Knowledge | Proprietary Herbal Formulations:

Invisible Value Driver: Cultural relevance fused with historical continuity and Ayurvedic authenticity.

Zandu’s strength lies in its heritage. It leverages cultural relevance, long-standing consumer trust in Ayurveda, and historical positioning to remain a go-to brand for wellness products. Even without aggressive digital presence or global scale, its brand equity in India and among the diaspora gives it enduring value. It rides on generational trust, indigenous formulation heritage, and alignment with Indian wellness beliefs. Unlike brands that push trends, Zandu builds on inherited trust — a uniquely Indian intangible rooted in culture, knowledge and legacy.

Impact on Valuation:

- Brand-Led Acquisition: Emami’s acquisition of Zandu was driven largely by its brand strength and heritage value, not physical assets.

- Market Positioning: In an era of rising health awareness, Zandu benefits from alignment with natural, preventive wellness trends.

- Moat Through Tradition: Its long-standing reputation and proprietary formulas reduce competition risk, enhancing perceived value.

- Pricing Resilience: Consumers often prefer trusted Ayurvedic brands over generics, allowing for sustainable margins.

These stories remind us: while assets depreciate, intangibles — when nurtured — appreciate in value over time.

Conclusion

In India’s evolving business landscape, especially for MSMEs and legacy brands, intangibles are no longer secondary. They are central to differentiation, resilience, and premium valuation. While balance sheets show what a business owns, intangibles reveal why it matters — to customers, to investors, and to the market.

Intangible assets—brand equity, intellectual property, customer relationships, proprietary technology, organizational culture, and data—are now central to enterprise value. They increasingly outweigh tangible assets, especially in India’s innovation-driven economy.

Companies like Colgate, Bisleri, exemplify how intangible factors support premium pricing, strong margins, resilient growth, and superior valuation multiples. These firms illustrate that what you don’t see on the balance sheet often matters most in value creation.

In a world where “essential” value is invisible, acknowledging and rigorously valuing intangible assets is not optional—it is imperative. India’s next wave of business success depends on recognizing these hidden jewels. Youth, professionals, and corporates alike must adopt holistic valuation mindsets, embracing both the measurable and the immeasurable to unlock true enterprise worth which can be identified through the Valuation process.

Knowledge Contributor: Mantraa Advisory

Mantraa Advisory has helped diverse businesses unlock value by leveraging intangible assets. Ranging from luxury brands to innovating Patents filed by businesses. In each case, Mantraa’s strategic articulation of intangibles strengthened valuation narratives of these businesses. Mantraa stands out as a valuation partner that marries deep technical expertise with strategic vision. With seasoned professionals across sectors, they can “wear both tails and heads”, delivering analytically rigorous yet business-context-driven valuations—perfect for Identifying Growth Strategy drivers, M&A, fundraising, compliance, or strategic planning.

This blog is Authored by Vinay Pandya, Managing Partner, Mantraa Advisory, a seasoned professional with qualifications as a CA, CS and Registered Valuer. With over two decades of experience, he works closely with businesses on valuation, fundraising, mergers and acquisitions, and strategic planning. In case you want to explore services of his company, contact is given in his profile.

(Subscribe for alerts to stay updated with new podcast episodes and blogs for MSMEs & Startups)