Contents

ToggleWarning Signs Your Business Might Be Undervalued

In this blog, Vinay Pandya, Managing Partner at Mantraa Advisory, explains why strong businesses often face weak valuations. The issue isn’t performance but perception — when narratives, intangibles, and future vision aren’t highlighted, the market applies a discount. With examples from Amazon, Uber, Nykaa, and HDFC, the blog shows how closing this perception gap helps businesses earn the valuations they truly deserve.

“Sometimes what you’re building is bigger than what you see — you just need the right lens to recognise its value.”

— Ratan Tata

Introduction: The Paradox of Strong Businesses, Weak Valuations

Many Indian promoters face a paradox. On paper, the business looks strong: revenues are growing, margins are healthy, operations run smoothly, and customers remain loyal. Yet when the time comes to raise funds, seek partnerships, or explore an exit, the valuation on the table feels… disappointing.

This leaves founders puzzled: How can a profitable, growing business not command the premium it deserves?

The reality is that valuation is never just about numbers. It’s about how your business is perceived. If your positioning, communication, and narrative don’t highlight the full story, the market applies a discount. Analysts, investors, and even customers often assign value not only to your current performance but also to your future potential, brand strength, and differentiation.

In simple terms: you can be strong inside but undervalued outside.

So, how do you know if that’s happening to you? Let’s break it down into two parts:

- What are the warning signs? → The visible symptoms that suggest undervaluation.

- Why is your business being undervalued? → The deeper reasons those symptoms exist.

(Subscribe for alerts to stay updated with new podcast episodes and blogs for MSMEs & Startups)

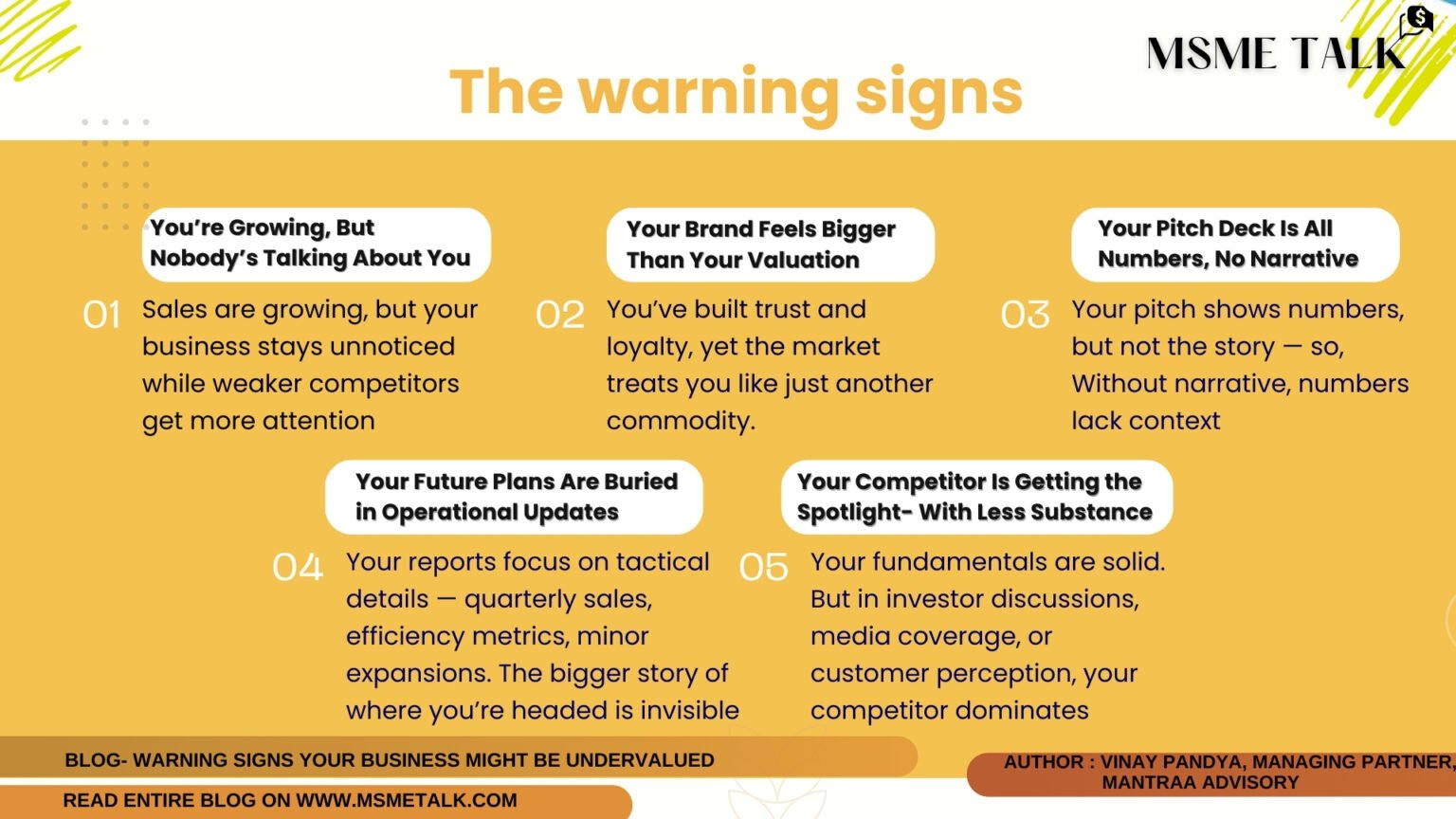

Part 1: What Are the Warning Signs that your business might be undervalued?

These are the outward signals that suggest the market is failing to fully recognize your worth.

1. You’re Growing, But Nobody’s Talking About You

Your sales are growing, profits are healthy, and customers keep coming back. But despite this progress, your business rarely gets mentioned in local trade associations, industry networks, or even by lenders. Meanwhile, competitors with weaker results seem to get more attention, more recognition, and sometimes even better financing terms.

Warning Sign: Recognition lags behind performance. If the market doesn’t notice you, it won’t reward you fairly.

Case Study – Amazon

In its early years, Amazon was dismissed as “just an online bookstore.” Investors valued it like a niche retail company, overlooking the scalability of its internet-first model. The breakthrough came when Jeff Bezos reframed Amazon as “the world’s most customer-centric company.” Suddenly, investors could imagine Amazon not as a small bookseller but as a limitless marketplace. Later, with AWS, Amazon shifted perception again — from retailer to technology infrastructure leader.

Lesson: If you’re boxed into a narrow identity, your valuation will be stuck there too.

2. Your Brand Feels Bigger Than Your Valuation

You’ve built trust, loyalty, and recognition with customers. People associate your brand with quality and reliability. Yet, the market still values you like a commodity operator, overlooking your intangible strengths.

W️arning Sign: Intangible assets — brand equity, customer love, proprietary know-how — aren’t being factored into your valuation.

Case Study – Uber

When Uber launched, analysts treated it like a taxi service: regulated, low-margin, hard to scale. What they missed was Uber’s real engine — its platform. With network effects, Uber created a self-reinforcing loop of riders and drivers, while its massive ride data offered unmatched insights. By expanding into food delivery, freight, and autonomous driving, Uber positioned itself as a mobility ecosystem, not a cab company.

Lesson: If your brand, IP, or network effects aren’t articulated, they’re invisible to the market.

(Are you a business or expert serving MSMEs and startups? Spotlight your services and expertise – partner with MSME TALK to create podcasts, blogs, listings, and social media content that truly reach and inspire!)

3. Your Pitch Deck Is All Numbers, No Narrative

Your pitch meetings are filled with financials, unit economics, and operating metrics. Investors see spreadsheets, but not a story. The bigger picture — your vision, your “why now,” your differentiation — gets lost in the details.

Warning Sign: Without narrative, numbers lack context. Stakeholders see performance, but not potential.

Case Study – Netflix

Netflix began as a DVD rental company, with rising revenues and happy customers. Yet analysts compared it to Blockbuster, assigning conservative valuations. When Netflix reframed itself as a streaming-first platform — and later, a technology + entertainment innovator with AI-driven personalization and original content — its valuation lens shifted completely.

Lesson: Numbers explain the past, but narratives shape the future.

4. Your Future Plans Are Buried in Operational Updates

You have a vision for scaling, new markets, and innovation pipelines. But stakeholders don’t see it. Instead, your reports focus on tactical details — quarterly sales, efficiency metrics, minor expansions. The bigger story of where you’re headed is invisible.

Warning Sign: Investors value you only on today’s performance, not tomorrow’s potential.

Case Study – Starbucks

For years, Starbucks was valued like a U.S. coffee chain. Analysts looked only at same-store sales and store count. The turning point came when Starbucks showcased its global expansion strategy and digital-first Rewards program, reframing itself as a lifestyle brand — the “third place” between home and work. The market then valued Starbucks not as a café, but as a global consumer-tech brand.

Lesson: If your growth story isn’t visible, your valuation is stuck in the past.

5. Your Competitor Is Getting the Spotlight — With Less Substance

Your fundamentals are solid. But in investor discussions, media coverage, or customer perception, your competitor dominates. They may not have stronger numbers, but they control the narrative — and therefore command a premium.

Warning Sign: Valuation is relative. If peers look more innovative or future-ready, your business looks weaker by comparison.

Case Study – HDFC vs. ICICI

For decades, both banks had strong balance sheets and profitability. Yet HDFC consistently commanded higher multiples. Why? Because HDFC positioned itself as disciplined, reliable, and digitally progressive, while ICICI was weighed down by governance concerns and weaker perception. Only after reforms did ICICI close the gap.

Lesson: The market doesn’t just value you; it values you against someone else.

(Also, Do not miss another blog by Mantraa Advisory- Beyond the Balance Sheet: How Intangibles Shape True Business Value, where it is explained that why intangibles like brand trust, promoter credibility matter more than balance sheets in driving valuations — with real examples from Bisleri, Colgate, Zandu, and Videocon)

If Part 1 highlighted the visible symptoms, Part 2 is about the root causes. These are the deeper structural reasons that explain why strong businesses often don’t get the valuation they deserve.

Part 2: Why are businesses being undervalued?

1. Narrative Blind Spots

Valuation is as much about storytelling as it is about financials. If your company hasn’t clearly articulated its “why now” (why the market opportunity is ripe) and “why you” (why you’re uniquely positioned), investors struggle to connect your performance with your potential.

Many promoters assume that numbers will “speak for themselves.” But without a compelling narrative, those numbers lack context. A 25% revenue growth can look impressive in one story — or ordinary in another.

Example: Consider Tesla. For years, its numbers didn’t justify its sky-high valuation. What did? Elon Musk’s narrative of building not just cars but an ecosystem for sustainable energy. That “big picture” lens is what the market bought into.

Takeaway: If you don’t own your story, the market will assign you one — and it may not be flattering.

2. Intangibles Missing from the Conversation

In today’s economy, intangibles often matter more than tangibles. Think about brand equity, intellectual property, proprietary data, customer loyalty, or network effects. These are the levers that drive long-term competitive advantage.

But unless they’re identified, measured, and showcased, they don’t show up in valuation models. Too many businesses treat intangibles as “soft factors,” rather than quantifiable assets.

Example: Coca-Cola’s brand alone is valued at billions of dollars, far exceeding the book value of its factories and equipment. Closer home, Infosys and TCS command premiums not just for their revenues, but for their reputations in talent quality and delivery discipline.

Takeaway: If your intangibles aren’t visible in the conversation, you’ll always look smaller than you really are.

3. Short-Term Thinking Dominates

Markets often judge companies by what they’re told. If you only communicate quarterly earnings, operational updates, or incremental improvements, you’re effectively inviting short-term judgment.

Investors don’t just want to know where you are today — they want to see where you’re going tomorrow. They want visibility into your pipeline of growth, innovation, and scalability. If that isn’t shared, they discount your future potential.

Example: When Reliance repositioned itself from a traditional energy business into a tech + digital ecosystem with Jio, the market dramatically re-rated it. The short-term numbers didn’t change overnight, but the future story did.

Takeaway: Show the road ahead, not just the road behind.

4. You’re Not Owning Your Category

In valuation, perception is relative. If you don’t define your own category, someone else will — and they’ll set the benchmarks. Competitors who claim category leadership often get rewarded with higher multiples, even when their fundamentals are weaker.

Example: For years, Nykaa positioned itself as not just an e-commerce site, but India’s leading beauty and lifestyle platform. By owning that space, it captured investor imagination and valuation multiples far higher than a “retail” label would have allowed.

Meanwhile, several equally strong niche players in personal care remained undervalued because they didn’t frame themselves as category creators.

Takeaway: Don’t just compete within a category. Shape it. If you’re defined by someone else’s lens, you’ll always trade at a discount.

5. Communication Is Reactive, Not Strategic

Many promoters communicate only when required — a quarterly call, a media query, or a compliance filing. This reactive approach means the market only hears from you when it asks, not when you want to shape perception.

Strategic communication, on the other hand, is proactive. It positions your achievements, innovation, and vision consistently, across channels. It doesn’t just tell stakeholders what you’ve done; it frames what it means for the future.

Example: HDFC Bank mastered proactive communication by consistently positioning itself as disciplined, reliable, and forward-looking. This wasn’t accidental — it was part of a deliberate effort to own its narrative. Contrast that with peers who left gaps for speculation, and you’ll see why HDFC traded at a premium.

Takeaway: Silence is expensive. If you don’t tell your story, the market will assume one — and it may not be in your favor.

6. Over-Reliance on the Promoter’s Image

Another subtle reason for undervaluation is when the market perceives the company’s success as inseparable from the promoter. While strong founder-led leadership is an asset, over-dependence creates the impression of fragility. Investors worry: “What happens if the founder steps away?”

👉 Example: Many mid-sized Indian businesses are highly promoter-driven, which caps valuations despite excellent fundamentals. By contrast, companies like Infosys institutionalised governance, systems, and professional leadership, reducing key-man risk and commanding global credibility.

Takeaway: A business must be valued for its systems, not just its superstar founder.

Conclusion: Closing the Perception Gap

Undervaluation isn’t always about weak fundamentals. More often, it’s a perception gap. If recognition, intangibles, growth stories, and peer comparisons aren’t aligned with reality, the market applies a discount.

The good news? This is fixable.

At Mantraa Advisory, we work with founders and promoters to uncover hidden strengths, align fundamentals with narrative, and reshape perception. By doing this, we help businesses command the valuation they truly deserve — not just for what they are today, but for what they can become tomorrow.

(Subscribe for alerts to stay updated with new podcast episodes and blogs for MSMEs & Startups)